KERPER BOWRON, LLCFOR IMMEDIATE RELEASEMay 1, 2025 | 1:30 PM EASTERN TIME Kerper Bowron Unveils Global Breakthrough in Solvency II Standard andRisk Modeling – Functional Equivalency to Article 77, Number 2 for ServiceContracts Dublin, Ireland — May 1, 2025 Kerper and Bowron LLC is a global leader in actuarial and financial consulting for service contracts based in Birmingham,

Category Archives: Accounting

Mergers and acquisitions (M&A) are central to growth and expansion in the insurance industry. These complex transactions require the expertise of professionals to confirm financial transparency, regulatory compliance, and strategic alignment. This blog explores how accounting and actuarial analysis facilitates insurance M&A, from initial valuation to post-merger integration. Navigating Financial Complexity Insurance M&A transactions involve

Frequency and severity are fundamental metrics in the insurance industry. Many traditional actuarial models depend on these assumptions to build pricing models. However, relying solely on frequency and severity can be misleading, and a deeper understanding is required to accurately assess risk. The Homeowners Insurance Example Take, for instance, the fire risk in homeowners insurance.

Kerper and Bowron LLC has moved to a new location in Birmingham. 600 University Park Place, Ste 310 Birmingham, AL 35209.

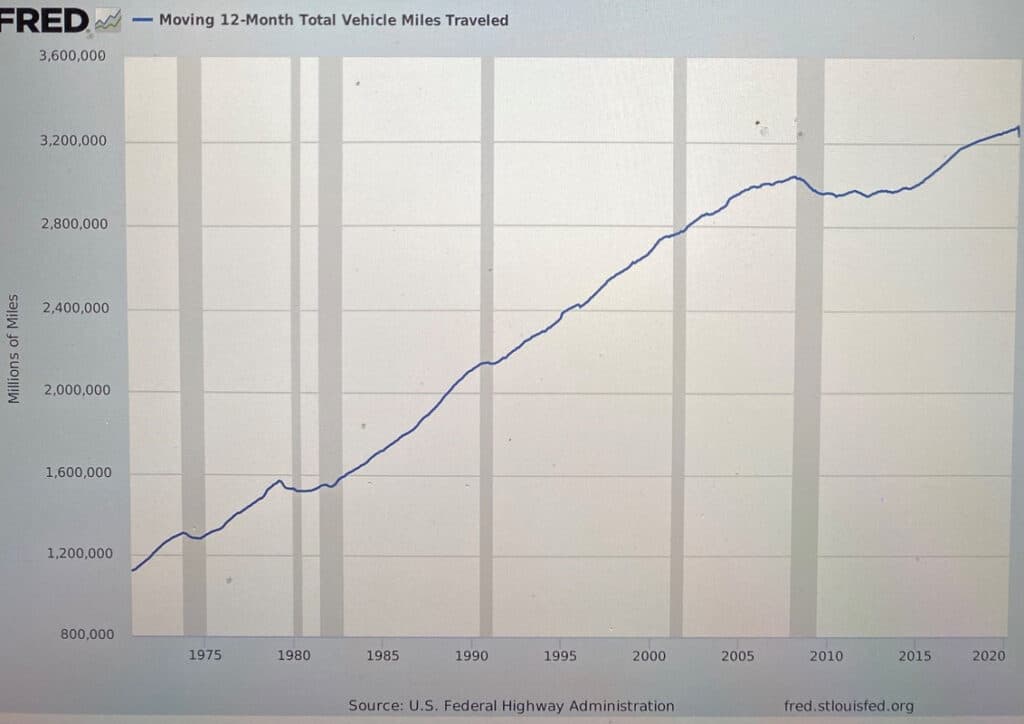

For vehicle service contracts (VSCs), the earnings curve is a critical tool for financial reporting and experience evaluation. Typically,…